From Ratings to Relationships: Re-imagining Sovereign Engagement with CRAs

The relationship between the leading Credit Rating Agencies (CRAs) and the Global South is becoming an increasingly prominent topic in discussions around global financial architecture. Views in this space diverge sharply. Some argue that the lack of CRA presence on the ground - particularly in regions like Africa - leads to systematic underappreciation of local context. Others suggest that criticisms of CRAs are overstated or fail to recognise the complexity of their role in global markets. Media investigations have offered inconclusive findings, while academic research has uncovered limited evidence of systemic anti-African bias - highlighting instead a modest pro-US bias. These debates have their place. But are they helping us move forward?

Examining whether or not such views are conducive to development is not my aim here. As I prepare to contribute to the Spring Meetings in Washington and the PrepCom in New York, my focus turns toward actionable ideas - ideas shaped by years of critique but tempered by dialogue, collaboration, and the privilege of engaging with experts across sectors. In every space I work in - from credit rating reform to sovereign finance – I am struck by the same theme: trust.

Trust, when built, transforms relationships. Trust, when absent, distorts them. So I ask: can trust be re-centred in the sovereign-CRA relationship?

In this short piece, I offer two proposals that seek to move us in that direction. They are grounded in practicality, responsive to longstanding concerns, and designed to empower both sides of the rating relationship. They are:

A model of Structured Engagement Forums, and

A voluntary CRA–Sovereign Engagement Charter.

Structured Engagement Forums

Bringing context, continuity, and collaboration to the credit rating conversation

Drawing on models like the IMF’s Article IV consultations, the OECD’s peer review mechanisms, and the World Bank’s Debt Sustainability Framework, I see a clear gap in the sovereign ratings space: while informal engagement between CRAs and sovereigns exists, there is no structured forum designed to support collaborative understanding ahead of ratings decisions.

So here is a proposal. Not a finished product - but a tested idea ready for development.

The aim is to establish dedicated, recurring spaces where sovereigns and CRAs can engage in pre-rating dialogue. These would be hosted by neutral convenors - regional development banks, multilateral bodies, or trusted third-party institutions. Participation would include senior finance ministry officials, regional political or economic representatives (e.g., the African Union), CRA analysts responsible for regional portfolios, and optional observers from multilaterals or technical bodies.

Crucially, these forums would be off the record, focused not on influencing outcomes, but on creating shared understanding. Key topics might include:

Reform timelines and policy justifications;

Development-linked trade-offs (e.g. social investment vs fiscal consolidation);

Climate and infrastructure risk strategies;

Clarification of technical data or risk model inputs.

The benefits?

For sovereigns: fewer rating shocks, better framing of complex narratives, improved internal capacity.

For CRAs: richer context, reduced reputational risk, stronger institutional links.

For the system: a more stable, transparent, and accountable sovereign finance environment.

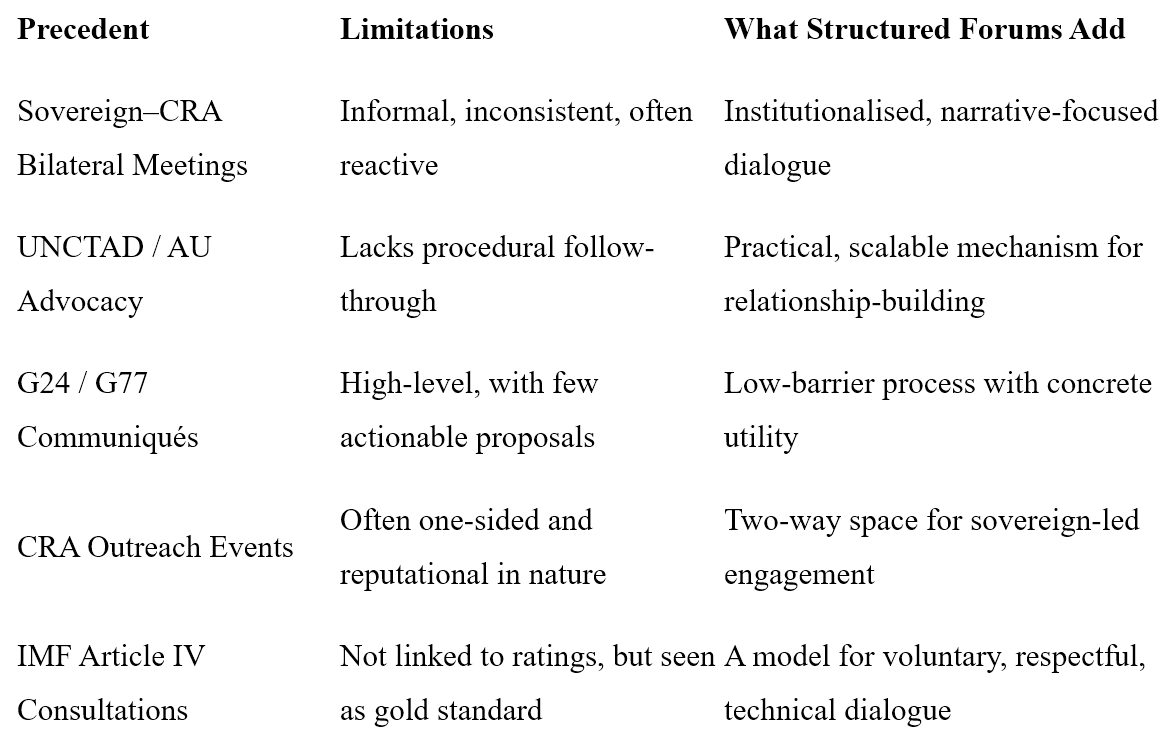

There is precedent for this kind of initiative in other domains of financial governance:

As I have said elsewhere: sovereigns do not want to influence ratings - they want to be understood before they are interpreted. Structured forums offer a way to meet in that middle space: independent, voluntary, and mutually valuable.

The CRA–Sovereign Engagement Charter

A voluntary compact to foster clarity, respect, and mutual understanding

As Official Development Assistance declines, many Global South countries are increasingly turning to the Eurobond market - deepening their dependence on private capital and, by extension, the decisions of CRAs. This intensifying relationship calls for more than ad hoc engagement. It calls for shared expectations.

The Charter is not a regulatory tool. It is a voluntary, principle-based agreement - a living document that defines what good-faith engagement looks like. Its purpose is to reduce ambiguity, rebalance the relationship, and provide a stable framework for engagement without compromising analytical independence.

A working draft might include:

Article I – Timeliness and Transparency of Communication

Predictable disclosure from sovereigns and clear review timelines from CRAs.Article II – Narrative Context and Developmental Trade-Offs

Recognition of long-term investment trade-offs by CRAs; proactive framing by sovereigns.Article III – Contact Protocols

Named contacts on both sides to ensure continuity and reduce reliance on informal networks.Article IV – Clarification Mechanisms

A post-rating window for clarification, with optional third-party facilitation if needed.Article V – Capacity Building and Mutual Education

Opportunities for joint learning—CRA workshops, sovereign briefings, and shared insights.

This is not about regulating engagement. It is about making it visible, predictable, and respectful. We already see this kind of soft governance in ESG charters, public–private development compacts, and climate finance frameworks. Why not here?

Conclusion: A New Compact for a New Era

Taken together, these two initiatives could begin to reshape the sovereign rating space - not by displacing agencies or constraining markets, but by deepening understanding and expanding the possibilities of engagement.

They offer the financial system an opportunity to evolve. They offer sovereigns a greater sense of dignity and voice. They offer CRAs a pathway to deeper credibility and relevance.

Now the question is yours: Can this work? Can we imagine enough will and determination to finally rebalance one of the most consequential relationships in global finance?